Snacking** is good for you

I often compare bookkeeping to exercise… it’s something we know we should do and the benefits are clear. With regular exercise, you can maintain a healthy body – it helps to keep your weight, blood pressure and cardiovascular health in check. Is it a panacea for a long, healthy life? No. But your chances are greater if you do exercise.

Likewise, with regular bookkeeping, you can maintain a healthy business. You understand your costs so you can price products for profitability. You can set sales targets that ensure your desired profits. You know in advance if you’ll hit a cash crunch and can prepare for it but hustling sales, cut back on expenses or taking out a line of credit. Is it a panacea for a thriving, prosperous business? No. But your chances are great if you keep up with your bookkeeping.

And like exercise, just because we know we should do something, doesn’t mean we do. There’s always something more pressing. Harvest, weed, feed chickens… Or… keep up with your QuickBooks. The long term benefits are elusive compared to the immediate needs of the farm.

Studies have shown that even a 2 minute burst of exercise, an “exercise snack“, can offer many of the benefits of a more rigorous routine, without a more arduous time commitment. If you can fit in a few “snacks” a day, you’ll be better off.

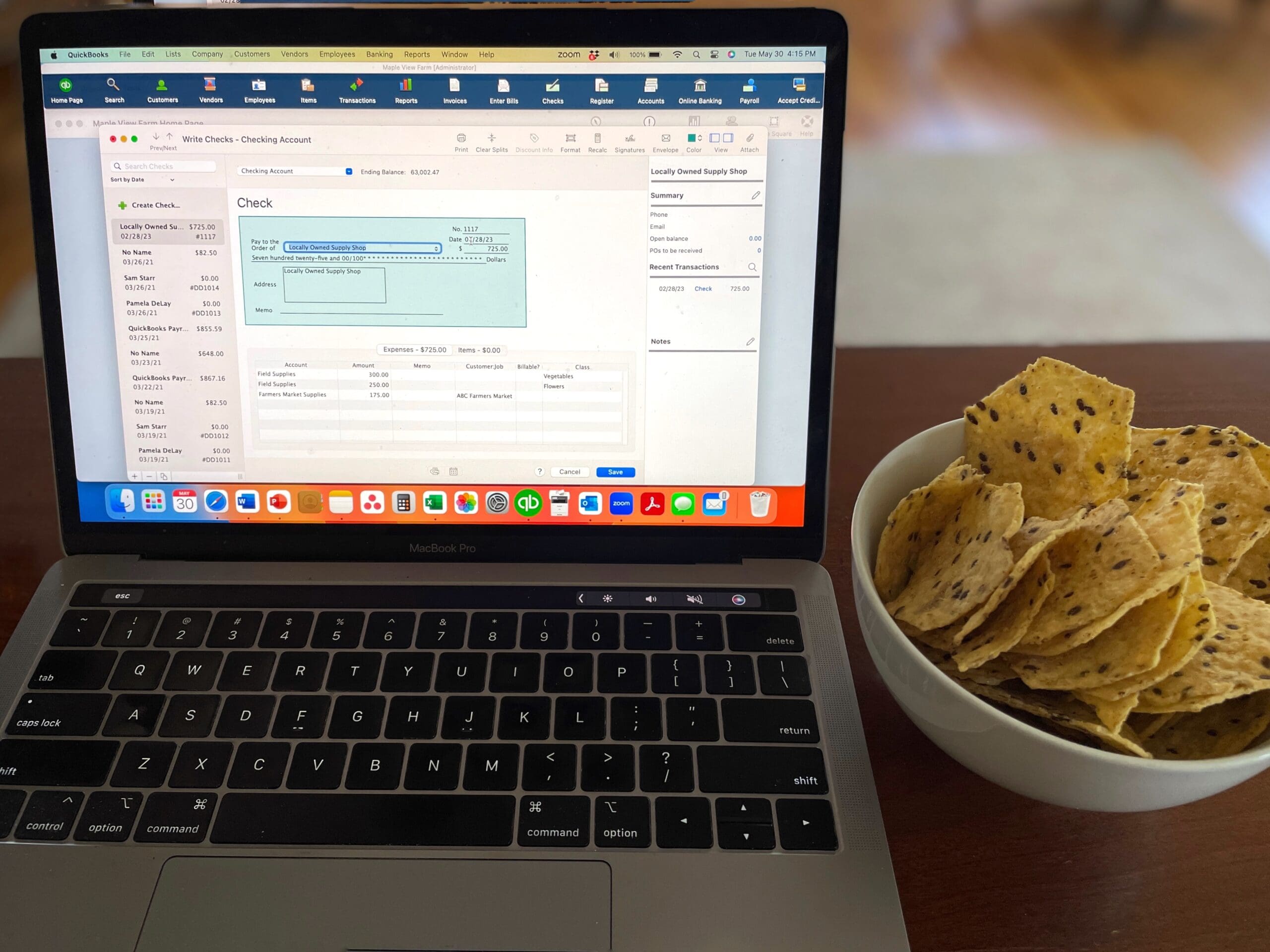

Likewise, bookkeeping can be achieved in bursts, or small bite-sized snacks. A few minutes here, a few minutes there, and you have a solid bookkeeping routine that will improve the health of your business.

As we head into the busy growing season, I recognize that time is in short supply, and all you’ll be able to fit in may be a few snacks.

With that in mind, I offer you 5 “bookkeeping snacks” to help you maintain a healthy business. Each “snack” shouldn’t take more than a few minutes. If you’re already sitting at your computer responding to emails or ordering supplies from amazon; you can quickly slot in a little snack.

Pro tip: add a script to your computer start-up to open QuickBooks (if you’re using desktop) or a browser with the QBO log-in page ready to go.

🍿Snack #1 – Catch-up on the bank feed.

If you set up the bank feed to sync with your QuickBooks, you can go through the list of transactions for review. If the transactions were previously entered, then you can match them to what you already entered. Otherwise, you can assign an account (according to the chart of accounts) and add them.

🍿Snack #2 – Check your cash position.

Cash rules the roost. It doesn’t matter if you have profits or margins, if you don’t have cash in the bank, then you’re in trouble. And if you don’t have cash in the bank, then you need to make sure you have a plan for cash inflow in the near future.

You can check on your cash position in several ways:

- Log into your online banking portal and check the balances in your accounts.

- Log into your credit card portal and check on your balances. Do you have enough in your bank to cover your monthly balance?

- Run an A/R Aging Summary Report. This report lists all the customers with outstanding invoice payments (accounts receivables). Customers that are in the current column have outstanding invoices but are not late in paying. Customers in the 1–30 columns and beyond are late in paying. Send a follow-up email or text to customers with outstanding invoices. If they are chronic late-payers, create a monthly statement and email.

If you have kept up on your sales and expense data entry, then you can get a quick snapshot of all the above details by running a Balance Sheet Report.

If your cash balance feels low, then consider what you can do in the next week or so to hustle sales, get payments from customers, or cut back on expenses.

🍿Snack #3 – Enter Sales from the past week.

Did you go to the farmers market this week? Did you make sales through an online payment system. Ideally, you can take the details of the sales (all the items you sold and in what quantity), along with the services fees, enter in a sales receipt and follow the cash flow as detailed in this video.

Okay…🤣🤣 I know that’s not realistic this time of year; and this is supposed to be a “snack” not 3 course meal (sorry for taking this analogy a little too far; bear with me).

If you don’t already have a system for tracking these credit card and online sales, I’d prefer you enter in something that you know you can fix, rather than nothing at all. The catch is this:

- You still want to enter the exact amount of the deposit (that is, what is stripe/paypal/grazecart going to deposit into your bank account?)

- How can you create a tagging system so you know to go back to the sales receipt to correct it when you have more time? A few thoughts:

- Download reports from your online sales system (stripe/paypal/grazecart), save them to your drive with an extension that tells you the time frame. I might do something like grazesales0611-0618.xls to signify a report from Graze Cart for the sales from June 11 – June 18th.

- For the sales receipt, creating a number system (yes you can customize the sales receipt number) that matches the report you downloaded. I might name it UP0611-0618 to mean: this is a receipt I need to UPdate for the week of June 11 – June 18th

When you have time to update the transactions, you can easily sort by transaction number and you’ll see all the UP transactions grouped together.

In other words, enter your cash inflows so that you have a good sense of your cash position (see snack #2) and have a system to easily update the transactions.

🍿Snack #4 – Pay Bills and Enter Expenses

No doubt, you have a stack of bills that came in the mail and/or an email inbox full of receipts. Whether you write a physical check or pay online, be sure to enter the transaction into QuickBooks as well. This will help you keep on top of your cash flow by proactively entering in the transactions rather than waiting for them to hit the bank feed. The bank feed tells you only when the transaction has cleared the bank, not when the check was written, nor the bankcard swiped. If you wrote checks that haven’t cleared, then your bank balance will be misleadingly high.

If the expense you’re entering is recurring (like your rent payment that happens once a month for the same amount each month) you can “memorize” (QB -desktop) or make the transaction recurring (QB-online).

🍿Snack #5 – Run a profit and loss statement.

It’s always helpful to look at your profit and loss. And the more you look at your reports, the easier they’ll be to read.

Depending on what time of the month you consume this snack, you will want to run the profit and loss for the time period of “previous month” or “this fiscal year to date.” You can further customize the report to show the same period of the previous year.

This will help you see:

- Sales are compared to last year: are they increasing as you expected?

- Expenses compare to last year: are you able to moderate them?

- Sales for this period compared to expenses: are you generating the profit you expected?

- The big expenses: did something happen you hadn’t budgeted for? Do you need to make adjustments to ensure you don’t hit a cash crunch.

If these “snacks” are new to you, feel free to join me for a speed-coaching session to discuss how you can apply these suggestions to your bookkeeping system.